-

Tax Impact

Before voting, it's important to know how a passing referendum will affect your taxes. The below information breaks down a positive referendum and its impact on local taxes and the Ag2School government tax credit.

How Will the Referendum Affect Your Taxes?

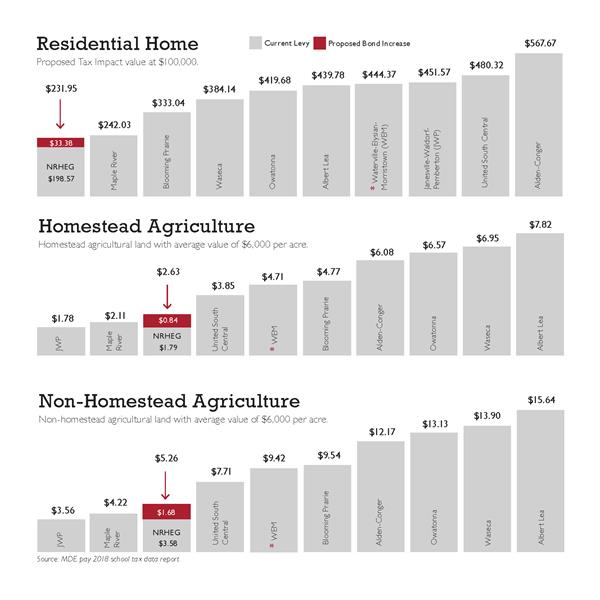

The following charts compare NRHEG to our neighboring Districts.

Affirmative Vote Impact

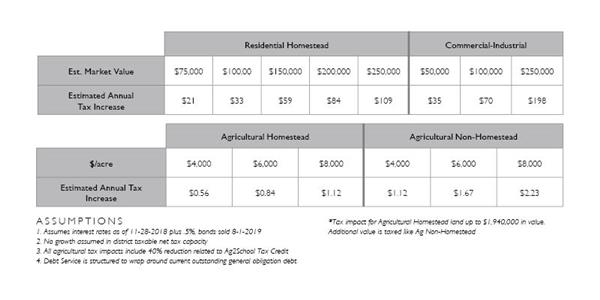

The following table shows the tax impact of a $9.1 million referendum on the NRHEG community.

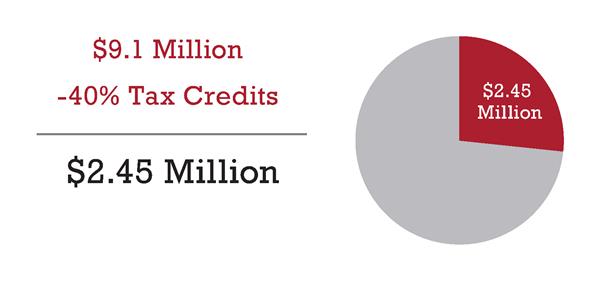

Ag2School Government Tax Credit

In the past, rural schools faced challenges to fund improvements. To help these efforts, the State of Minnesota implemented the Ag2School tax credit with bipartisan support. This reduces the financial burden on farmers in the area. It offsets 40% of bond debt that is levied on agricultural taxpayers.

This permanent bill does not have a sunset clause, meaning there is no end date and that the bill will be effective for the entirety of the bond. Repealing this law is highly unlikely, as it would require both houses of Congress and the governor’s approval to do so. Moreover, repealing this bipartisan law would be a vote for raising taxes, which both parties would likely avoid given the political consequences of such a vote.