-

NRHEG Public Schools Funding Request November 3, 2020

The NRHEG Board of Education (BOD) unanimously approved asking voters for local financial support through an operating levy request on the November 3, 2020 ballot. This decision follows recent BOE action that approved a $200,000 deficit spending budget for 2020-2021 after making more than $160,000 in reductions.

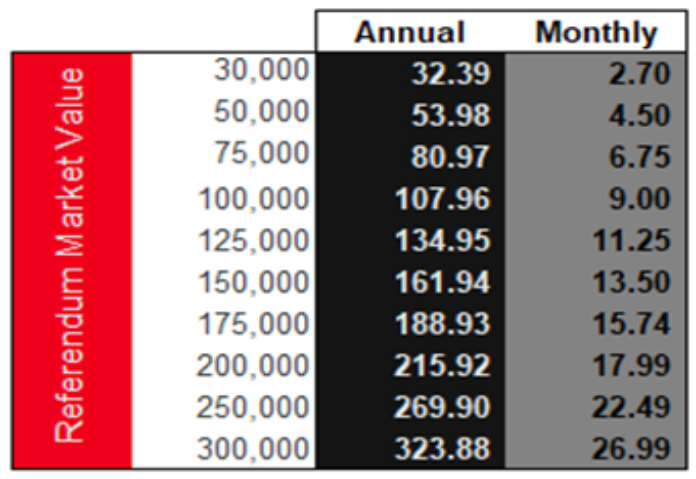

The ballot question asks voters whether to approve a levy increase that would increase school funding by $560 per pupil annually over a ten-year period. If voters approve the additional revenue, the tax impact on a $125,000 home is projected to be about 11.25/month. The increase in revenue, per student, to the school district would be about $47/month.

The decision to put the operating levy on the ballot was based on several months of discussions and review of various options. The BOE took this action now after examining carefully the school district’s financial history, present fiscal position and best budget projections looking several years into the future. Guiding the BOE’s work has been its commitment to the school district’s Strategic Plan beginning with the priority goal area of Student Achievement. Equally important is the BOE’s focus and commitment to the priority goal of Finance and to “preserving the district’s strong financial standing while maintaining programs, services, and facilities at maximum efficiency.”

The operating levy request is in response to a number of financial pressures that will result in expenses exceeding revenue starting in the 2020-21 school year - challenging the District’s ability to maintain the quality education students deserve and the community expects. These pressures include state funding that has not kept pace with inflation and additional unfunded mandates which draw resources away from the general fund (spending directly for our students). District voters approved a request in 2009 for an additional $450, however since then, these funds have been repurposed due to changes in our state laws.

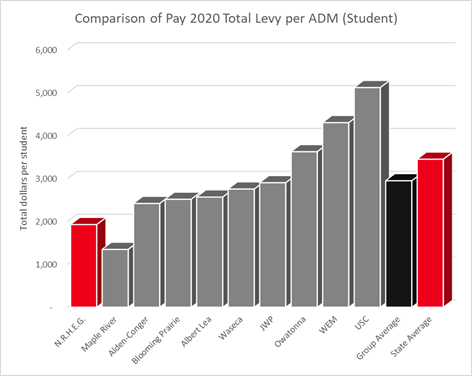

How do we compare, in terms of revenue, to other public schools in Minnesota?Currently, our district does not have any additional local funding, that has been approved by our voters, to pay for the costs of operating our schools. Operating levies provide critical funding for classrooms, instruction and other operating costs. Of the 332 school districts in Minnesota, 226 currently have locally approved operating levies, providing important financial support for their schools.

In a report recently published for last school year (2019-2020), NRHEG Public Schools ranked 276th out of 332 school districts in revenue received. The report considered the following revenue sources:

- General Education

- Referendum and Local Optional

- Special Education

- Faculties

Source: schoolsforequity.org

Note: This graph shows total tax impact before the Maple River Schools successful building referendum last February.

The BOE made the decision to ask voters for more revenue based on several factors including but not limited to:

- Increase in state aid over the past five years has not kept pace with the District’s operational expenses, mandated purchases, and employee wages/benefits.

- After making more than $160,000 in operational expenditure reductions for the 2020-2021 school year while still planning for a $200,000 deficit in spending, additional revenue is needed in order to maintain current programs and operational services.

- Schools throughout our region are investing more in their students than we are in NRHEG

- As part of community surveys in 2018 and 2016, respondents identified priorities including

- Maintaining current class sizes and course offerings

- Recruiting and retaining high-quality staff

- Updating Career and Technical Education curriculum, equipment, and facilities

- Sustaining curriculum replacement cycle

- Utilizing latest technology in classroom

- Expanding mental health services

- Preparing students for life after high school including college and/or career

- Increasing student achievement in literacy

The BOE has determined the increased revenue is needed in order to maintain and address the priorities listed above.

Managing our Revenue and Expenses

For the past five years, the BOE has been closely monitoring and examining the most efficient and effective use of taxpayer dollars in order to make progress in meeting the goals and objectives of the school district’s Strategic Plan. As early as 2016, the school district was projecting a flattening or decrease in student enrollment which is the primary driver of state aid for the school district. At the same time, the 2% average increase in state aid over the past five years has not kept pace with the school district’s operational expenses, mandated purchases and employee wages/benefits.

The BOE has determined the increased revenue is needed in order to maintain and address the priorities listed above.

If voters approve the levy, the operating levy funding would be used to:

- Maintain quality programming and learning opportunities for students

- Attract, retain, and fairly compensate high-quality teachers

- Build a path to long-term financial stability

“Seeking additional revenue from voters is the only option available for our school district if we what to maintain our current programming and services,” said Board Chair Rick Schultz. “Through careful planning, we have worked to address unfunded and underfunded needs for years. There has been a reluctance to approach the communities seeking this funding because the School Board has always wished to practice the highest level of stewardship with the resources provided.”

Impact on our Taxes

If voters approve the levy, the average homeowner ($125,000 value home) would see school tax increases averaging $11.25 per month.

Additional value examples are as follows:

Tax Impact CalculatorFor a tax impact on a specific property please use the Tax Impact Calculator.

Operating Versus Building Needs

Needs associated with this operational referendum should not be confused with taxpayer support in approving the April 2019 building referendum. The 2019 referendum focused on addressing needed classroom repairs, safety improvements and deferred maintenance. The November 2020 operating referendum addresses operational services, programming and other ongoing or recurring costs that cannot be sustained within the current revenue limits received from the state and local taxpayers.

NRHEG Public Schools is proud of who we are, the people we serve, and the people who provide services to students, families and our communities. We also believe strongly in offering a wide range of opportunities within the classroom and beyond the classroom to help our young people learn, grow, and have the most options and the best options available to them in the future.

It does take quite an investment to educate every student every day, and your school district is committed to continuing that service and value to not only our students and the families we serve, but to our communities. The BOE realizes that the investment the school district needs to make requires resources in the form of time and money. The BOE takes its fiscal responsibility very seriously; just as the BOE takes asking for financial support very seriously. The BOE is appreciative of the community support the school district continues to receive. The BOE works hard to continue to earn your trust.

More information regarding the operational needs and the financial projections of the school district will continue to be added to the website so that you can make an informed decision on November 3. Thank you in advance for your interest and for taking time to be informed about the November 3, 2020, operational referendum question to increase the general education revenue for the school district so that our school community can maintain as well as grow educational opportunities for our students.